Introduction

In today’s world, having a good credit score is crucial. It affects everything from loan approvals to interest rates you qualify for. A higher credit score can open doors to favorable financial opportunities, making it a key component of financial health. Understanding how scores work and how you can improve them is important for managing your long-term financial goals. Many feel overwhelmed by the process; however, boosting your credit score can be achieved faster than you might think. With a strategic approach, the path to credit improvement can be both swift and effective.

Understanding Credit Scores

Credit scores serve as a numerical representation of your creditworthiness. They are typically calculated using information from your credit report, accounting for factors like your payment history, debt levels, and length of credit history. The most common scoring system is the FICO score, which ranges from 300 to 850. The higher your score, the more trustworthy you appear to potential lenders. Understanding how these scores are calculated can demystify the process and help you take meaningful action to improve your score. Remember, knowledge is power, especially in the world of finance.

Timely Payments Are Key

Your payment history constitutes about 35% of your credit score, making it the most influential factor. Prioritizing on-time payments is crucial, ensuring you’re at least meeting minimum payment requirements each month. Late or missed payments can significantly damage your score, while consistent, timely payments build trust with creditors. Setting up automatic payments or regular reminders can help ensure payments are made on time. Over time, these habits can positively impact your credit profile. In short, staying on top of your bills is a fundamental step in improving your credit score quickly.

Reducing Debt Levels

Another vital component of your credit score is your debt load and how it compares to your credit limits, known as your credit utilization ratio. Ideally, this ratio should be below 30% to positively impact your score. Begin by paying down existing debts gradually, starting with those that have the highest interest rates or smallest balances. Consolidating debt or negotiating plans with creditors can also provide relief and assist in lowering your credit utilization. By keeping your debt levels in check, you create a stable financial foundation that boosts your creditworthiness.

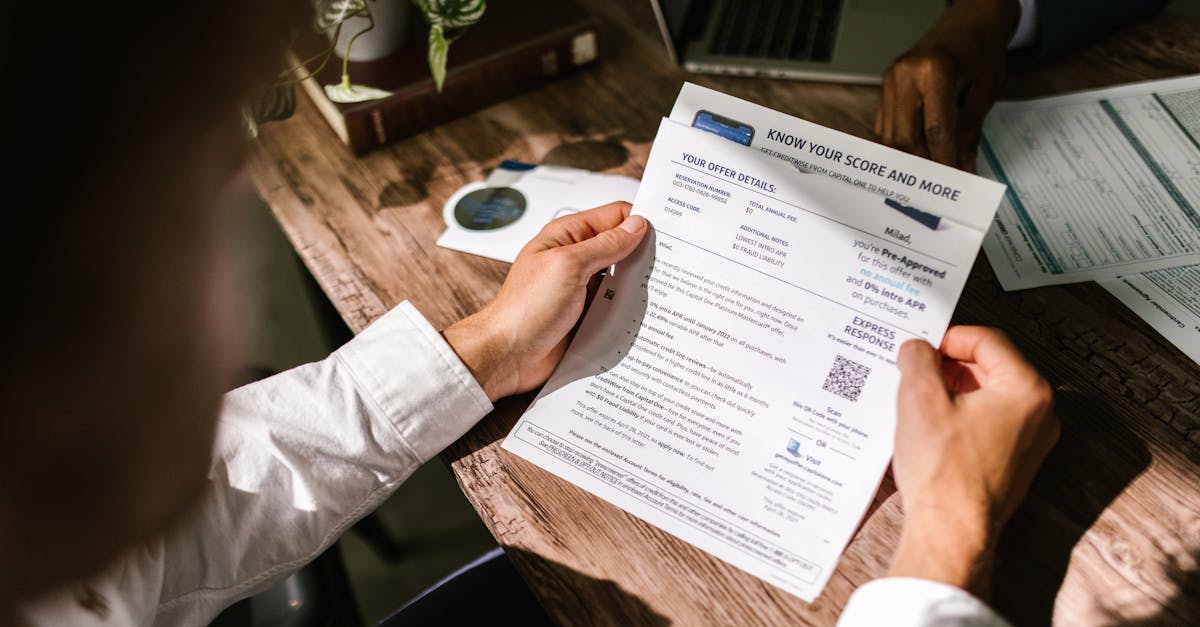

Monitoring Your Credit Report

Regularly reviewing your credit report ensures accuracy and alerts you to any discrepancies or fraudulent activities that could harm your score. You're entitled to a free report annually from each of the major credit bureaus: Equifax, Experian, and TransUnion. If you spot any errors, such as incorrect account information or unrecognized accounts, dispute them immediately to have them corrected. Transparency with your credit report helps you maintain control and prevents unwarranted damage to your credit score.

Strategically Opening New Credit

While opening multiple new accounts at once can harm your score, strategic opening of credit can benefit it. Responsible use of new accounts can help diversify your credit mix, which accounts for 10% of your score. Choose credit options that align with your current financial habits, ensuring you can manage additional responsibility. However, be cautious of excessive inquiries within a short timeframe, as they can decrease your score. Balancing the strategic opening of new credit with responsible management is an effective way to build or rebuild credit.

Maintaining Long-Term Focus

The length of your credit history accounts for another 15% of your credit score. It’s beneficial to keep your oldest accounts open, as they increase your average age of credit and demonstrate a long track record of payment reliability. Avoid closing accounts abruptly or frequently switching credit cards. Instead, construct a solid, long-term financial history by maintaining existing accounts responsibly. This approach not only stabilizes your score but improves your financial reputation over time.

Seeking Professional Advice

If you’re overwhelmed by the process, consider seeking help from credit counseling services. Certified credit counselors can provide personalized advice and help create a customized plan to improve your credit score. They often offer workshops and educational sessions to deepen your understanding of credit management. Professional guidance can illuminate paths you might not have considered and expedite the improvement process. With the right support, you can tackle credit challenges head-on and optimize your financial well-being.

Considering Quick Fixes Carefully

Some alternatives for fast score improvements may seem enticing, but be wary of quick fixes that promise massive increases overnight. Strategies like applying for a rapid rescore or becoming an authorized user on an account with a stellar history can be beneficial, but they need to be pursued with care. Quick fixes should complement, not replace, long-term strategies. Ensure you thoroughly understand any option before proceeding to avoid potential pitfalls that could be counterproductive.

Conclusion

Improving your credit score rapidly is possible with strategic planning and disciplined financial habits. By focusing on timely payments, managing debts responsibly, and maintaining a long-term outlook, you can achieve noticeable results. While monitoring your progress and seeking professional advice can further enhance your journey, always approach credit improvement with a cautious mindset. Fully understanding your score and credit report empowers you to take control of your financial future. Actively embracing these techniques ensures robust credit health and opens doors to a wealth of financial opportunities in the future.